Summary of Proposed Changes

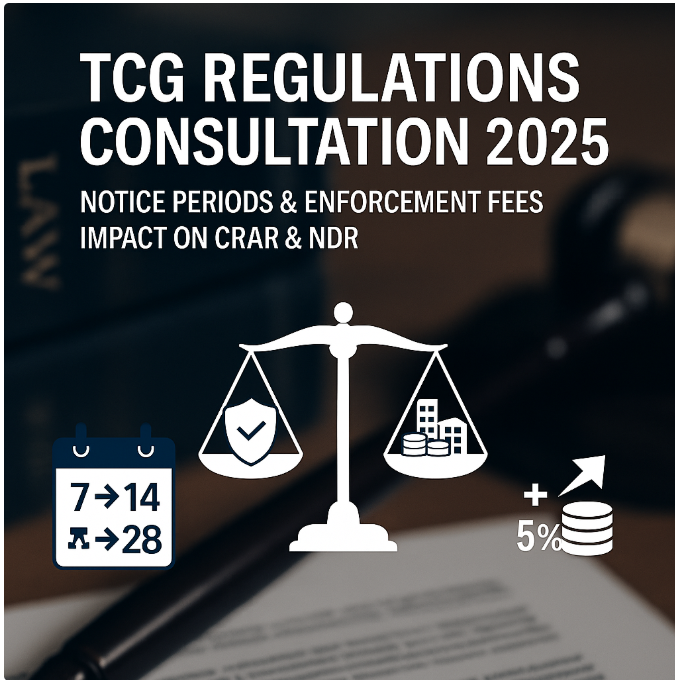

The UK government’s Taking Control of Goods Regulations Consultation proposes extending statutory notice periods for enforcement actions. While the reforms apply across multiple debt types, this analysis focuses on the potential impact on Commercial Rent Arrears Recovery (CRAR) and Non-Domestic Rates (NDR).

- Notice period: Minimum 7 → 14 days, with an option for debt advisors to request an extension to 28 days.

- Fees: A proposed 5% uplift to statutory enforcement charges, the first increase since 2014, plus a 7.5% rise in the percentage-fee threshold from £1,500 to £1,625.

Who this affects: Commercial landlords using CRAR and local authorities collecting NDR, along with business occupiers and commercial tenants navigating arrears.

Current Framework for CRAR & NDR

Under the Tribunals, Courts and Enforcement Act 2007 and the Taking Control of Goods Regulations 2013 , enforcement agents (EAs) must provide at least 7 clear days’ notice before taking control of goods for unpaid commercial rent (CRAR) or NDR. The same framework governs council tax, magistrates’ fines, and parking penalties.

The proposed reform would double the CRAR and NDR notice period to 14 days, with a possible extension to 28 days upon a debt advisor’s request, to strengthen debtor protections and early engagement.

Potential Advantages of Longer Notice Periods

More Time for Resolution

Longer notice can promote advice-seeking, payment negotiations, and settlement, aligning with best practice such as vulnerability assessments and realistic repayment options.

Improved Public Confidence

Extending notice periods may mitigate concerns about aggressive enforcement, increase transparency, and reinforce standards for accredited firms regulated by the Enforcement Conduct Board (ECB).

Support for Vulnerable Debtors

Distressed businesses may use additional time to seek professional advice or restructure, preventing avoidable closures and wider disruption.

Potential Drawbacks of Longer Notice Periods

Risk of Evading Enforcement

With 14–28 days’ notice, tenants or occupiers may vacate, transfer, or remove assets before enforcement. For CRAR, this could include stripping stock or equipment; for NDR, occupiers might claim a change of occupier. Courts can still order shorter notice where there’s a real risk of goods being moved.

Delayed Recovery

Landlords and councils often face urgent cash-flow needs. Longer notice periods defer recovery and may undermine the value of swift, compliant enforcement.

Higher Operational Costs

Monitoring cases for longer increases administrative burden and risk exposure for enforcement agents operating in challenging environments.

Proposed 5% Uplift in Enforcement Charges

The sector broadly welcomes the first statutory fee increase since 2014 to reflect inflation, complexity, and safety investment. However, higher fees can deepen hardship for already struggling debtors, especially where insolvency is a risk. A balanced approach is required: maintain sector viability without disproportionately impacting vulnerable businesses.

The Key Question: Should Notice Periods Be Extended?

Commercial tenants and business occupiers typically have greater mobility and asset-shielding capacity than domestic debtors. Extending notice across the board— without safeguards —risks undermining enforcement effectiveness for CRAR and NDR.

Pragmatic pathway: adopt tiered notice periods by debt type and risk. Retain 7 days for higher-risk CRAR/NDR scenarios where swift action is essential, allow 14–28 days in lower-risk or vulnerability-flagged cases, and preserve judicial discretion to shorten notice where assets are at risk.

Conclusion & Recommendations

- Support flexibility: tier notice periods to case risk and debt type.

- Introduce safeguards where notice is extended (e.g., targeted powers or directions where dissipation risk is evidenced).

- Modernise fees to sustain compliance, training, and agent safety—while embedding protections for vulnerable debtors.

We encourage landlords, councils, and industry stakeholders to engage with the reform process to achieve genuine protection and practical enforcement.