What Is CRAR – Commercial Rent Arrears Recovery?

A Statutory Rent Recovery Procedure for Landlords

Commercial Rent Arrears Recovery (CRAR) is a statutory enforcement route available to landlords of commercial premises in England and Wales. It allows for the lawful recovery of unpaid rent without needing to pursue court action.

CRAR enables the landlord to instruct Certificated Enforcement Agents to take control of the tenant’s goods. UK Bailiffs ensures that each instruction is managed in strict compliance with the legislation, maintaining professionalism and clarity at each stage.

Legal Framework

CRAR was enacted through the Tribunals, Courts and Enforcement Act 2007. It replaced the former common law remedy known as distress for rent and introduced clearer procedural safeguards for both landlords and tenants.

Recovering Rent Arrears

Recover Unpaid Rent from Commercial Tenants Using CRAR

Landlords of commercial properties can use a statutory enforcement method to recover overdue rent — quickly and without involving solicitors or court proceedings.

What is CRAR?

Commercial Rent Arrears Recovery (CRAR) is a statutory process that lets landlords recover unpaid rent by appointing certificated enforcement agents.

- No need for a court order

- Applies only to business premises

- Fast and fully compliant process

Who Can Use It?

- You’re a landlord of a commercial unit

- A written lease outlines the rent clearly

- No residential part — unless separately let

What’s Covered?

This method allows recovery of pure rent only — it excludes service charges, interest, or other liabilities.

How Soon Can You Act?

Once rent is 7 days overdue, enforcement can begin. After serving notice, agents can attend the premises if payment isn’t made.

If Payment Isn’t Received

- Enforcement agents attend the premises

- Goods may be listed under a controlled goods agreement

- Assets can be removed and sold if necessary

This is a landlord's legal right to collect unpaid rent directly — no court needed.

Why Choose UK Bailiffs?

- Same-day action available

- Nationwide enforcement

- Our costs can be recovered from the tenant

- Experienced, certified agents

Is a Solicitor Required?

No — simply instruct our agents and we’ll handle the entire process.

What You'll Need

- Lease agreement

- Summary of arrears

- Tenant’s contact info

We’ll guide you every step of the way.

Trusted Nationwide

We’ve supported landlords and managing agents across the UK in recovering millions in unpaid rent.

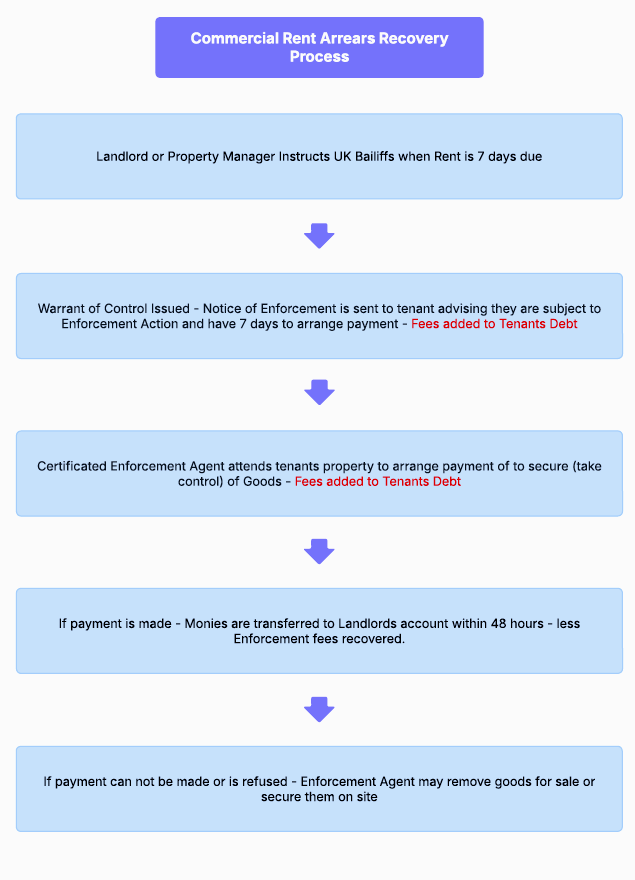

Our CRAR Process

We operate this service swiftly and lawfully under Part 3 of the Tribunals, Courts and Enforcement Act 2007. Below is a clear breakdown of how our process works.

📄 Step-by-Step CRAR Procedure

1. Instruct Us Online: Submit our short form — it generates a compliant Warrant of Control automatically.

2. Initial Assessment: We confirm eligibility based on your lease and outstanding rent.

3. Notice of Enforcement: A 7-day Notice is served on the tenant, offering time to pay and avoid further action.

4. Enforcement Attendance: If payment isn’t received, our Certificated Enforcement Agents attend to take control of goods.

5. Sale of Goods: If needed, seized items are sold at auction to recover the rent owed.

6. Final Reporting: We provide a full report, including photographic evidence and recovery status.

Pros and Cons of Using CRAR

This legally statuted service offers landlords a streamlined process to recover unpaid rent without going to court, but it also has limitations. Here's a breakdown:

Advantages

- No court action required

- Fast enforcement via Certificated Enforcement Agents

- Costs can be passed to the tenant

- Only applies to rent, avoiding broader debt disputes

- Protects landlord rights under commercial lease terms

Disadvantages

- Only available for commercial premises (no mixed-use)

- Cannot recover service charges or insurance premiums

- 7 clear days’ notice required before enforcement

- Does not apply if tenant is insolvent

- Tenant goods may have little resale value

CRAR Enforcement Timeline

Below is a typical timeline from instruction to enforcement under the CRAR process:

- Day 0: Landlord instructs enforcement agent (e.g. UK Bailiffs ).

- Day 1: Notice of Enforcement served to tenant — 7 clear days required.

- Day 8: If payment is not made, enforcement agents attend the premises.

- Same day or shortly after: Agents take control of goods under a Controlled Goods Agreement or remove goods for sale.

- Within 7 days: Payment, settlement, or auction arrangement finalised.

Note: The “7 clear days” excludes Sundays and Bank Holidays.

CRAR and Tenant Insolvency

CRAR cannot be used against a tenant who is subject to formal insolvency proceedings. This includes:

- Company voluntary arrangement (CVA)

- Administration

- Liquidation (compulsory or voluntary)

- Bankruptcy (for sole traders)

Attempting CRAR while the tenant is protected by a moratorium or administration order can result in legal penalties. In these cases, landlords should seek specialist insolvency recovery advice or consider lease forfeiture as an alternative remedy.

CRAR vs Lease Forfeiture: Comparison for Commercial Landlords

This table compares two key remedies available to commercial landlords when tenants fall into arrears: Commercial Rent Arrears Recovery (CRAR) and Lease Forfeiture.

| Feature | CRAR | Lease Forfeiture |

|---|---|---|

| What is it? | A legal procedure to seize tenant goods to recover rent arrears without court proceedings. | The landlord re-enters the premises and terminates the lease due to rent arrears or breach of lease. |

| Legal Basis | Tribunals, Courts and Enforcement Act 2007 | Common law right + lease forfeiture clause |

| When Can It Be Used? | Only for commercial leases with written terms. Rent must be 7+ days overdue. | For breach of lease (commonly non-payment of rent). Must comply with peaceable re-entry rules. |

| What Can Be Recovered? | Rent, interest and VAT only — not service charges or insurance. | None — the lease is ended. You gain possession but not the arrears (unless pursued separately). |

| Speed | 7 clear days’ notice must be served before attendance. | Can be executed immediately if lease allows and peaceable re-entry is lawful. |

| Outcome | Tenant remains in possession. Goods may be seized and sold to recover debt. | Tenant loses possession. You regain the premises and may re-let. |

| Risk Level | Low – follows regulated process. | Medium to high – risk of unlawful re-entry if not handled correctly. |

| Ideal Use Case | Landlord wants to recover arrears while keeping tenant in place. | Landlord wants to terminate lease and regain control of property. |

Use our free Determination Tools for Landlords to check if Commercial Rent Arrears Recovery is legally applicable before taking action.

Instruction Form

Completing the form does not constitute a contract or acceptance of the instruction.

Where instructions relate to Commercial Rent Arrears Recovery (CRAR), all instructions are subject to our CRAR Terms and Conditions of Instruction.

Once submitted, we will email you a copy of the Warrant for acceptance and then begin the process. We may also request further details as part of our due diligence procedures. If you have any questions regarding the instructions, please email our team at help@ukbailiffs.org.

If you are unsure whether or not you can use CRAR, please check our free Interactive CRAR Determination Tool.

FAQ

CRAR — Frequently Asked Questions

These FAQs explain CRAR at a high level. They are general information only and are not legal advice. If your matter is time-sensitive or contested, consider obtaining advice from your solicitor.