NEWS and Updates

Freeman of the Land Claims vs Council Tax Enforcement: Myth vs Law

We recognise that some people sincerely believe online information suggesting statutory debts are optional or require personal consent. This guide explains the actual legal position for Council Tax and similar debts, with references to UK statutes and case law. It aims to prevent further hardship—many people have lost property by relying on false advice.

1. Commonly Raised Misconceptions

| Claim | Reality (Law) |

|---|---|

| The “Strawman” theory (legal name vs living person) | UK courts reject arguments that a separate “legal entity” avoids liability. Names are interpreted by substance, not styling or punctuation ( Armitage v Nurse [1997] EWCA Civ 1279 ). |

| Consent required / Statutes are contracts | Statutes bind everyone in the jurisdiction. R v Brown [1994] 1 AC 212 confirms obligations are not a matter of consent. |

| Common law overrides statute | Pickin v British Railways Board [1974] AC 765 confirms Acts of Parliament are supreme over inconsistent common law. |

| Magna Carta reliance | Almost all clauses were repealed. The few remaining do not affect council tax liability or enforcement. |

| “Alternative courts” or “world courts” | Only courts constituted by the Courts Act 1971 and recognised higher courts have jurisdiction. Private or internet “courts” have no legal standing. |

| Commercial liens against officials | Courts strike out pseudo-liens. Only lawful, registrable charges or court-ordered securities are valid ( Midland Bank Trust Co Ltd v Green (No 3) [1982] Ch 529 ). |

| Bills of Exchange Act 1882 / VAT invoice demands | Statutory debts are not negotiable instruments, so the 1882 Act doesn’t apply. Council Tax is outside the scope of VAT; penalty charges are not VAT invoices. |

| Name formatting / punctuation | Capital letters or punctuation do not change identity or liability ( Armitage v Nurse ). |

| WeRe Bank & “mortgage elimination” | The Financial Conduct Authority and UK courts treat such instruments as worthless; using them may be fraudulent. |

| Right to travel / maritime law | Irrelevant to domestic taxation. Enforcement is based on Acts of Parliament, not admiralty law. |

| UCC filings | The UCC is US law and has no force in the UK. UK courts disregard UCC-style filings. |

| Human Rights Act 1998 misuse (Article 8) | Rights are balanced with lawful authority. Enforcement under TCEA 2007 Sch. 12 is proportionate and lawful in pursuit of taxation and justice. |

| Data Protection Act / GDPR misuse | The Data Protection Act 2018 permits processing where necessary for compliance with a legal obligation, including debt enforcement. |

| “Bills need a judge’s wet-ink signature” | Certification and electronic sealing are sufficient ( CPR r.5.4 and Practice Direction 5B ). |

| “No contract = no obligation” | Council Tax is a statutory obligation under the Local Government Finance Act 1992 —no signed contract is required. |

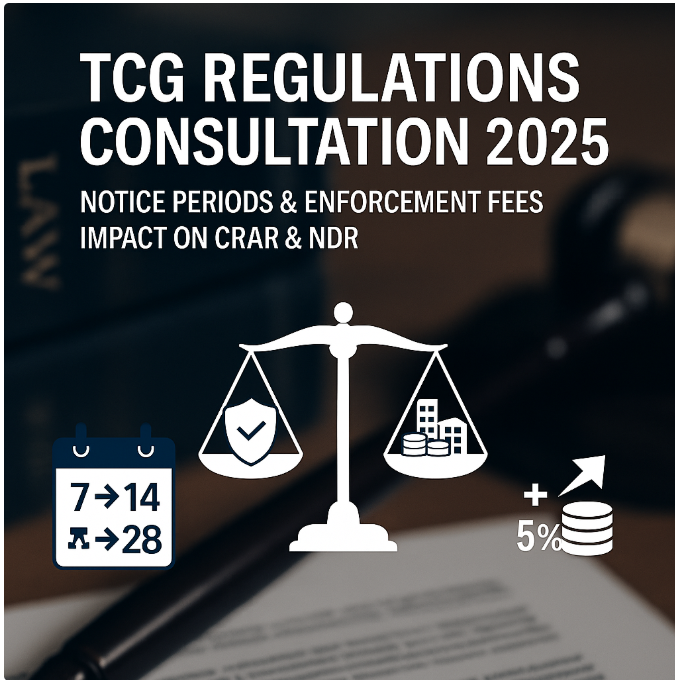

| “Distress not allowed after 2014” | Old “distress” was replaced by modern powers in the Taking Control of Goods Regulations 2013 and TCEA 2007. |

2. Council Tax Liability

Created by the Local Government Finance Act 1992(ss.6–8). Liability arises automatically for residents, owners and tenants. Personal consent is not required.

3. Liability Orders

Made under the Council Tax (Administration and Enforcement) Regulations 1992. In R (Kofa) v Oldham MBC [2024] EWHC 685 (Admin), the High Court confirmed that enforcement does not require a “wet-ink” order to be produced at the door—court records and certification suffice.

4. Enforcement Powers

Enforcement is governed by Schedule 12 of the Tribunals, Courts and Enforcement Act 2007 and the Taking Control of Goods Regulations 2013. Powers include attending premises, taking control of goods, and removing/selling goods to satisfy the debt. These powers do not depend on the debtor’s agreement.

5. Criminal Misuse & 6. Consequences of False Advice

Presenting false instruments, obstructing enforcement, or using fraudulent documents may constitute offences under the Fraud Act 2006(s.2) and the Forgery and Counterfeiting Act 1981. Courts routinely reject OPCA-style arguments. Outcomes have included seizure of vehicles and possessions, additional enforcement fees, bankruptcy or repossession, and—where criminal conduct is present—prosecution.

Appendix: Key Statutes & Cases

Statutes & Regulations

- Local Government Finance Act 1992 (ss.6–8)

- Council Tax (Administration & Enforcement) Regulations 1992

- Tribunals, Courts and Enforcement Act 2007 (Sch. 12)

- Taking Control of Goods Regulations 2013

- Data Protection Act 2018

- Human Rights Act 1998 (Art. 8)

- Bills of Exchange Act 1882

- Fraud Act 2006

- Forgery and Counterfeiting Act 1981

- Courts Act 1971

- Civil Procedure Rules r.5.4 & PD 5B

Cases

- R (Kofa) v Oldham MBC [2024] EWHC 685 (Admin)

- Pickin v British Railways Board [1974] AC 765

- R v Brown [1994] 1 AC 212

- Armitage v Nurse [1997] EWCA Civ 1279

- Midland Bank Trust Co Ltd v Green (No 3) [1982] Ch 529

- R v Bentham [2005] UKHL 18